In the financial world, one of the most well-known names is Berkshire Hathaway Inc., the multinational company headed by renowned investor Warren Buffett. Berkshire Hathaway has established itself as a model for profitable long-term investing because to its high stock price and varied holdings. In-depth analysis of Berkshire Hathaway’s past, present, and potential future developments are provided in this blog article. It also examines the factors that contribute to the company’s high stock price.

The History of Berkshire Hathaway

Early Beginnings:

Originally founded as a textile manufacturing enterprise in the 19th century, Berkshire Hathaway has its roots in the past. The company had financial difficulties for many years as a result of the American textile industry’s decline, despite being named for its starting locations in Massachusetts.

Warren Buffett’s Acquisition:

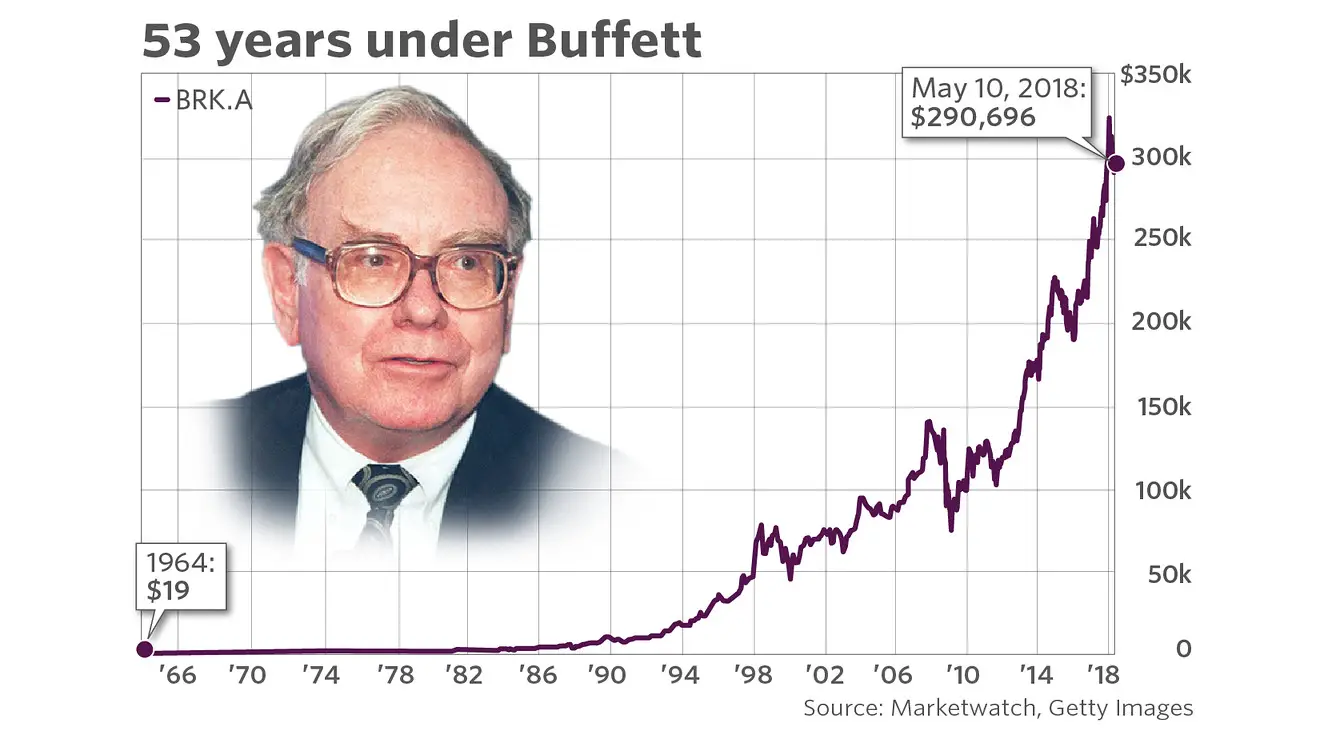

When young investor Warren Buffett started purchasing Berkshire Hathaway shares in 1965, it was a significant turning point. Buffett was then operating a partnership. Upon observing that the stock price of the company was below its inherent value, Buffett made his first investment in it. Buffett took over the company, though, and changed its emphasis from textiles to investing in other ventures following a split with the management.

Transformation into a Conglomerate:

Under Buffett’s direction, Berkshire Hathaway started acquiring stocks and other companies and progressively shifted its focus from textiles. Through this change, Berkshire Hathaway became a more diverse conglomerate. BNSF Railway, See’s Candies, Dairy Queen, and insurance companies like GEICO and National Indemnity Company were among the notable acquisitions.

Reasons Behind the High Stock Price

Compounding Returns:

Compounding returns are one of the main factors driving Berkshire Hathaway’s high stock price. Buffett’s approach to investing is centered on long-term ownership of high-quality companies that are purchased at reasonable prices. Over the years, the company’s worth has increased significantly as a result of this strategy.

Reinvestment Strategy:

In contrast to many businesses, Berkshire Hathaway reinvests its earnings back into new ventures and acquisitions. The stock price has increased as a result of this reinvestment strategy’s sustained expansion.

Strong Management:

Known as the “Oracle of Omaha,” Warren Buffett and his business partner Charlie Munger have played a key role in the development of Berkshire Hathaway. Berkshire Hathaway has distinguished itself from other corporations with its methodical approach to investing, in-depth knowledge of firms, and aptitude for spotting long-term value.

Diversified Portfolio:

From retail and manufacturing to energy and insurance, Berkshire Hathaway’s varied business spans a wide range of industries. Better than enterprises focused in a single area, this diversification lowers risk and guarantees that the business can weather economic ups and downs.

Share Structure:

At hundreds of thousands of dollars a share, Berkshire Hathaway’s Class A shares (BRK.A) are among the most expensive stocks available. Buffett’s choice to keep the stock exclusive and reduce trading activity is partially to blame for its high price. In addition, the corporation provides Class B shares (BRK.B) at a lower price point than Class A shares.

The Future of Berkshire Hathaway

Succession Planning:

Planning for succession has become a crucial issue for Berkshire Hathaway as Charlie Munger and Warren Buffett get older. By designating important managers who will have different responsibilities, Buffett has handled this. With a solid foundation and culture set by Buffett and Munger, it is predicted that the corporation will carry on with its successful investing strategy under the new leadership.

Technological Investments:

Berkshire Hathaway has been investing heavily in technology in recent years, acquiring substantial shares in firms such as Apple and Amazon. The move toward digital investments is a sign of both future growth potential and an adjustment to the shifting economic conditions.

Continued Acquisitions:

The future of Berkshire Hathaway most certainly entails more acquisitions of superior companies. Due to its considerable financial reserves, the corporation is able to expand its portfolio and possibilities for growth by making large investments and acquisitions.

Market Adaptation:

Sustaining Berkshire Hathaway’s prosperity will depend on its ability to adjust to shifting market conditions and changing industry trends. Future performance of the organization will be significantly influenced by its capacity to recognize new trends and make investments in creative businesses.

FOR MORE LATEST AND INTERESTING BLOGS PLEASE VISIT OUR PAGE = https://usabloghouse.com/blogs/

Conclusion

Given its impressive track record of long-term growth, rigorous management, and strategic investments, Berkshire Hathaway’s high stock price is not surprising. Built on a foundation of financial competence, Berkshire Hathaway began as a modest textile concern and has since grown into a diversified multinational led by Warren Buffett. The business is still a shining example of profitable investing and a blueprint for creating long-term value as it manages succession and keeps up with market changes.